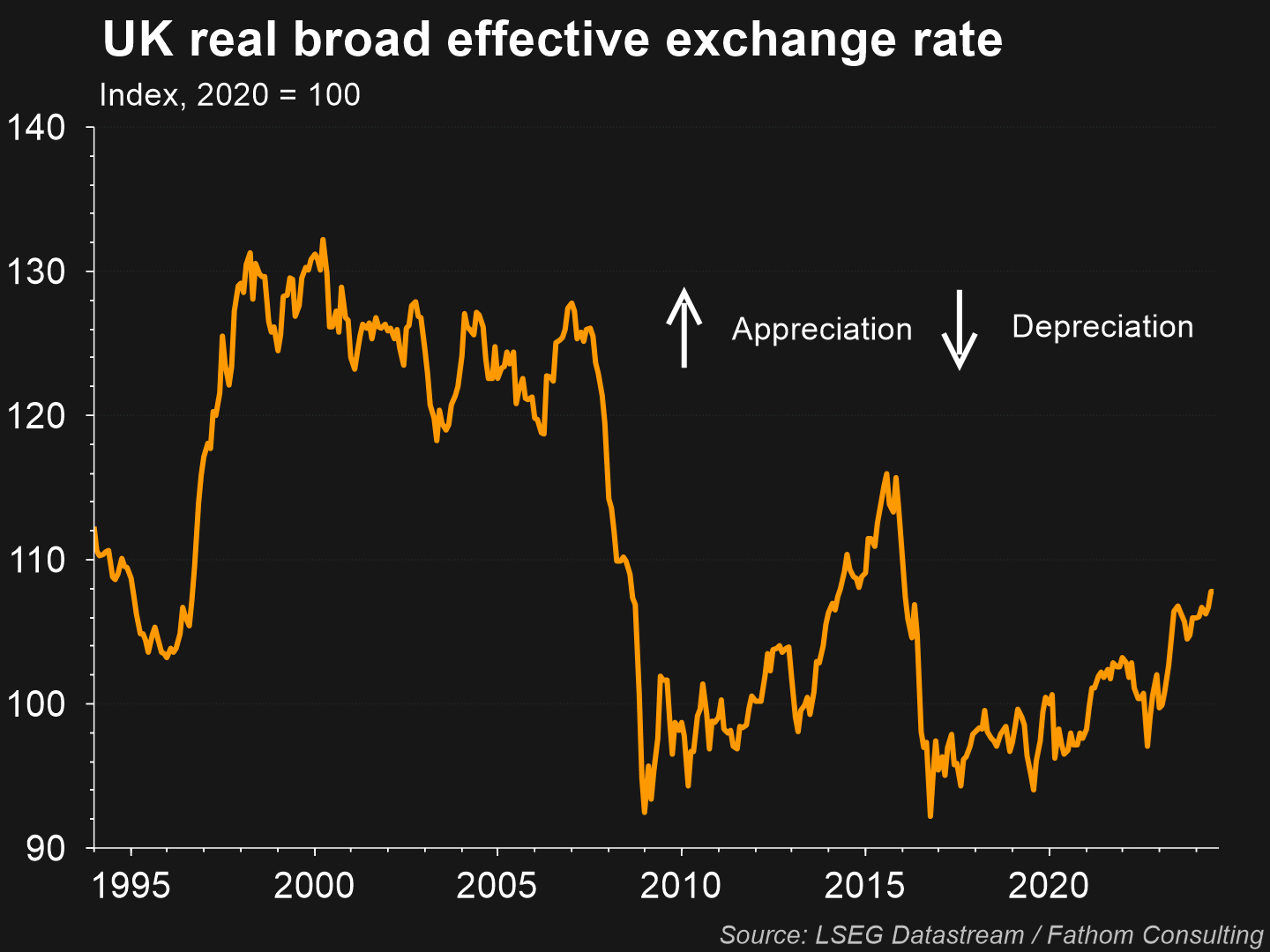

From the perspectives of both the UK economy and market, the UK’s recent political change is encouraging after the last decade’s disappointing investment performance with a consistently turbulent political backdrop. The UK is now led by a Labour party that inherits an economy that is past the worst stage of its downturn. The new leadership are likely to provide stability with a large mandate, which will encourage both domestic spending and more FDI (Foreign Direct Investment). The ‘Brexit discount’ on all UK financial assets has scope to gradually narrow and we are particularly bullish on UK equities on a long-term view. Sterling looks well underpinned by likely inflows despite the falling rate environment.

The new Labour party majority is fragile, relying on a collapse of the SNP vote in Scotland, tactical voting, and the splitting of radical right support. To sustain the support that he will need to implement his growth and investment initiatives, PM Starmer will need to stabilize existing social tensions quickly. PM Starmer and his new team are being tested with riots across the country that are being partly driven by immigration concerns. He is adopting a firm approach to the riots, and the immigration numbers are now starting to fall. The curbs on visas for skilled workers, and for health and care and study, are beginning to have a significant impact.

Over the last five years, the UK economy has been confronted by four major negative shocks. Firstly, Brexit imposed significant additional administrative, logistical and wage costs on businesses. Secondly, Covid crushed the goods sector (as it did globally). Thirdly, the energy crisis due to the Ukraine war put significand upward pressure on prices. Finally, the Liz Truss leadership was less than 50 days in duration but nevertheless significantly undermined the UK’s hard-won reputation for sound economic management. All of these four factors are now normalizing, leading to economic stabilization and likely slight pickup over the next twelve months.

Revised data from the Office for National Statistics (ONS), giving more weight to the healthcare and energy sectors, has shown that the UK economy emerged from the pandemic in a stronger condition than previously thought. This is the third successive year of upward revisions for the decisive Covid recovery year 2022. While this does not impact on the growth and fiscal outlook looking forward, it is likely to have impact on local sentiment and on foreign investors perceptions of the UK.

The UK economic performance since Covid can now be viewed as close to the average of its G7 peers, not worse as previously thought. The economy grew by 1.1% over the first half of 2024 (a 2.3% annualized rate), which was above the growth in all other G7 countries.

Looking forward there are increasing signs of post-Covid normalization and economic stability on a variety of measures. After the severe terms-of-trade shock in 2022 when the UK’s energy prices rose strongly, the balance between export and import prices has returned to the pre-pandemic level. Wage growth has remained firm even as the labour market has weakened. Business confidence has picked up due to falling energy costs and the likelihood of domestic political stability, while consumer confidence has been supported by rising real incomes, which should lead to pickups in both investment and personal consumption next year. The new leadership are looking to revive growth further through their housebuilding and onshore wind initiatives.

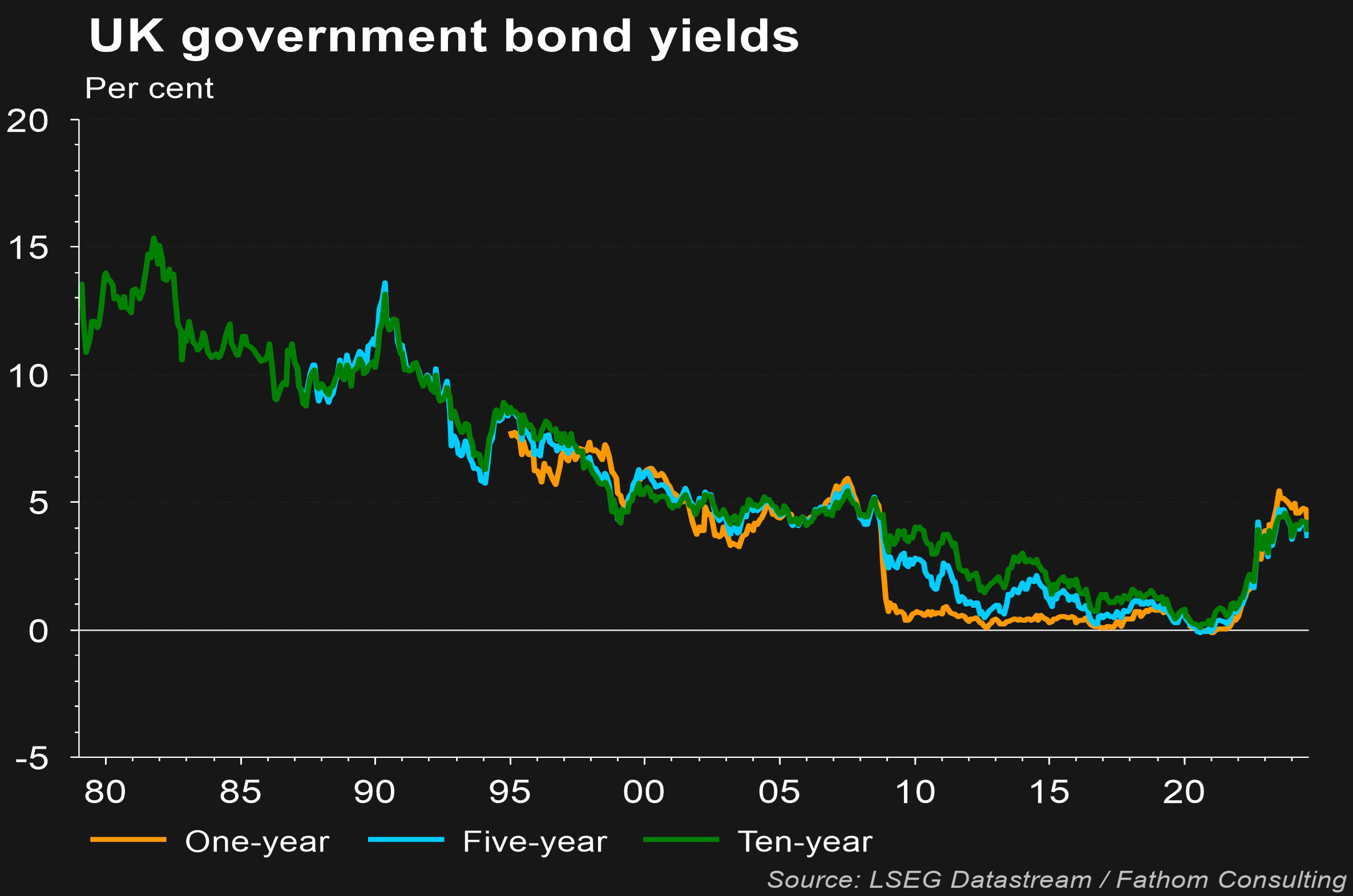

Core inflation has steadily fallen towards the Bank of England’s 2% target. The start of the rate cutting cycle began last week and has further to go in the coming months, even with wages in the services sector remaining stubbornly high. Falling rates over the next 18 months should offer further support for business investment, consumer spending and the property sector.

There is also a gradual normalization in another area, the Bank of England’s balance sheet. Quantitative easing for 15 years following the global financial crisis of 2008, led to the Bank of England’s balance sheet ballooning to GBP 1 trillion. That process is now in reverse, with the Bank of England not just waiting for Gilts to mature but rather actively selling them, resulting in it’s balance sheet shrinking to GBP 760 billion, on course to fall to it’s “steady state” of around GBP 400 billion. The fact that this has occurred without a Gilt market selloff, during a period of simultaneous high Gilt issuance to fund the 4.4% fiscal deficit, is indicative of the bond market’s growing confidence that the UK economic management is regaining credibility and reliability.

New Chancellor Reeves is a Thatcherite with one of her core beliefs being that the UK should not spend beyond its means, and that growth should be driven by the government helping to incentivize investment. A key aim is to drive investment in order to raise the UK’s current dismal productivity level. This approach is likely to see the fiscal deficit gradually improve and the debt level (at its highest level since the early 1960’s) gradually fall.

Private equity: Within private equity the UK Chancellor Reeves is keen to attract private investors to fund infrastructure and green energy projects, and wants to create a supportive environment for inward investment.

Fixed income: Within the Gilts market there are many bonds offering good duration and liquidity. A Sterling IG portfolio with an average credit rating of A- and duration slightly above the 4.08 benchmark, could offer a weighted average yield to maturity of 4.9%. The average weighted coupon of 3.7% would be supported by likely capital gains as the base rate falls further and as the longer-bond yields are likely to have peaked.

Property: The UK residential property sector is usually a good barometer of the economic outlook and sentiment, given the high level of home ownership. The sector will get support from the recent first rate cut. In addition, certain areas like housebuilding will benefit from relaxed planning processes which is expected to boost development. The Royal Institution of Chartered Surveyors (RIC) said its monthly survey of estate agents pointed to “a meaningful pick-up in sales volumes going forward” in July. Their survey found more respondents expecting both sales volumes and prices to rise in the short-term and also over the year ahead than in June. The RIC’s sales expectations net balance, the difference between the percentage of estate agents expecting rises and falls – rose from 22% in June to 30% in July.

Listed equity: Within listed equities many stocks are cheap (average 14X earnings) with above-average dividend yields (average 3.64%), suffering from an ongoing ‘Brexit discount’. The discount should close as the UK’s risk premium steadily declines and as other global markets, particularly the US, look fully priced and well-owned. Lower interest rates should also support a higher rating, while high single digit EPS growth is expected in the next twelve months. Significant laggard sectors over several years, notably mining and financials, which also have large index weightings, now look cheap versus their histories and cheap relative to overseas comparables. For several months there has been rising momentum in the leveraged buyout area and in addition mergers & acquisition activity has been rising, both trends driven by cheap valuations.

The stockmarket looks poised to see higher institutional inflows. The local institutions are likely to be incentivized by streamlined listing requirements and removal of stamp duty on share purchases. In addition overseas investors are diversifying into the UK, as seen in the equity ETF inflows of $1.9bn so far this year. Local retail investors (with £430bn of investible cash savings) are likely to be incentivized by sale of government shares in companies like Natwest.

Currency: Sterling is a ‘safe haven’ with expected USD pressures later this year, and the Euro facing France and ongoing Ukraine challenges. The currency has moved back to its pre-Brexit level against a basket of foreign currencies.

In addition to this positive fundamental and valuation backdrop for all UK asset, there could be a revival of the 2023 Mansion House agreement – an initiative for UK pension funds to agree to allocate 5% of their assets into unlisted UK equities by 2030. So far 8 of 11 signatories to the agreement are developing new funds or vehicles to increase unlisted equity investment. Several of the signatories say that the main problem for their client is not regulations but fees associated with private assets. There are now increasing efforts to assess how scale can be achieved in order to bring down costs and fees.

With this in mind Chancellor Reeves is also currently meeting bosses of big pension funds in Toronto, with the aim of creating a “Canadian-style” model in the UK, with retirement funds incentivized to invest in equities and infrastructure. Reeves is looking to consolidate 86 individual local government pensions schemes and then mobilize their combined assets of 360 billion Pounds.

In addition to more cooperation in areas like defence, climate change and data security protection, the UK leadership might consider a revival of some form of enhanced customs arrangement or single-market membership through reviving the UK’s membership of the EFTA (European Free Trade Association). These steps would be welcomed by foreign portfolio and direct investors.

The UK’s period of disappointing investor returns is coming to an end. There is unlikely to be an immediate ‘V’ shaped economic and market recovery. We expect a gradual recovery with periodic disappointments and consolidations. The key points are that the improvement is coming off a depressed economic and earnings levels, as well as off depressed financial asset valuation levels, and is likely to be sustained by supportive policy as well as by inflows from both very underweight investors and newly-incentivized local pension funds.